Meezan Consumer Edge has a Shariah compliant financial assistance facility for the purchase of durable consumer goods such as air conditioners, refrigerators, generators, etc. Under this facility, Meezan Bank will approve a full limit for you after evaluating your application. You can then purchase durable goods from the range of products offered by the bank to the amount of facility approved for you.

Meezan Bank Durable Goods Financing Benefits

1. For the first time, limit the financing facility for consumer durable goods

2. Ideal financial support according to the Shariah of Maaswamah

3. Easy option of installment for six (6) to twenty four (24) months.

4. The limit is suitable for 3 years, and will be used for durable purchase goods

5. The financing limit is at least PRs. 35,000/- and maximum 1,000,000/-

Meezan Bank Durable Goods Financing Scheme Eligibility Criteria

1. Citizenship: Must be a citizen of Pakistan.

2. Age Limit: For Salaried Individuals, the age limit will be at least 20 to 60 years at maturity.For Self Employed Business/Self Employed Profession, the age limit will be at least 20 to 65 years at maturity.

3. Minimum Income Required: For Salaried Individuals, the grosssalary will be 25,000 per month and for SEP, the monthly income must be at least 40,000 as well as businessmen.

4. Debt Burden Ratio: For SI, SEP and SEB the net monthly income must be 35%.

5. Down Payment: At least 15% of cost of the market price.

6. Tenor: 6, 12, 18 and 24 months.

7. Late Payment: No charges for late payments.

Meezan Bank Durable Goods Required Documents

1. For Salaried Individuals:

a) One valid copy of applicant’s CNIC

b) One recent passport size photograph of the applicant

c) Certificate of financing declaration

d) Signature of verification form

e) One original and certified copy of the statement of the bank at least past 6 months

f) Must provide original and certified copy of payment slip

g) Must provide the certificate of employer which include tenor and designation

2. For SEP/SEB:

a) One valid copy of applicant’s CNIC

b) One recent passport size photograph of the applicant

c) Certificate of financing declaration

d) Signature of verification form

e) Must provide one original and certified copy of statement of bank at least past 12 months

f) Must provide documentation proof of business at least past 2 years along with tax return certificate and any other documents.

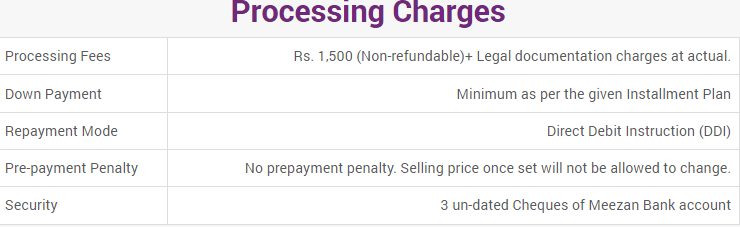

Meezan Bank Durable Goods Financing Scheme Processing Charges

Meezan Bank Durable Goods Financing Scheme Calculator

In order to know interest rate/ markup rate, tenure period along with installment, please visit the given below link: https://www.meezanbank.com/calculators/

Meezan Bank Durable Good Online Apply

In order to apply for Meezan Bank Durable Goods Financing Scheme 2021, please visit the given link below and fulfill the application form with required documents and submit it to the nearest Meezan Bank branch.

Application Form: https://www.meezanbank.com/wp-content/themes/mbl/downloads/consumer-ease-form.pdf

Meezan Bank Helpline

For further information, please call us on +92 21 111 331 331

For any queries or suggestion, please email at info@meezanbank.com / complaints@meezanbank.com