Meezan Bank provides loans for building or buying a house in Pakistan

Meezan Bank provides interest free loans to all Pakistanis who do not have a private home and want to build their own.

Businessman Salary Person Professionals Dr. Eng. Government Employees and Private Employees

Meezan Bank provides loans for four purposes

1) To build a house ( This includes both plot purchase and house construction )

2 ) If you have a plot ( So a loan can be taken for the construction of a house )

3 ) To renovate the house

4 ) To replace the house

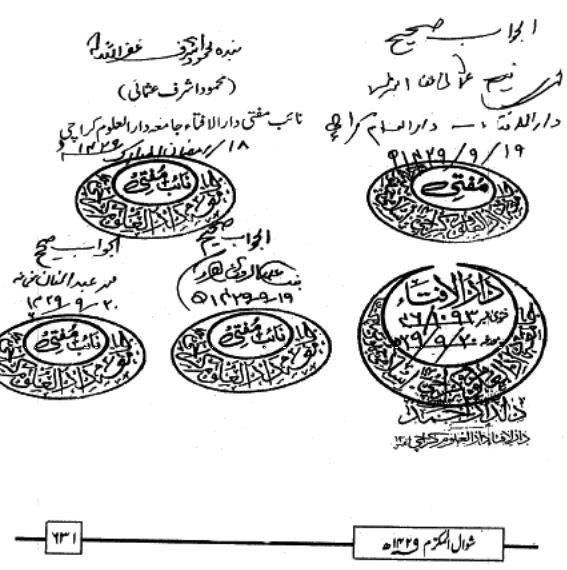

Meezan bank home loan fatwa

fatwa has been issued by Meezan Bank

Three major clerics have ruled that Meezan Bank’s home loan scheme is interest-free.

The bank will only charge the service charge from the customer

Meezan bank home loan eligibility criteria

Meezan Bank will provide loan to the customer on the following conditions

- Customer must have Pakistani nationality

- Customer must be between 25 and 65 years of age

- If two people are borrowing together ( So their age should be between 21 to 70 years )

- One man can take a loan and two men from the same family can take a loan

- Salary person’s monthly income should be up to 40,000

- The monthly income of a self-employed person And Businessman is up to 75,000

- The salaried person has been employed for at least 2 years and have a two-year employment history.

- The businessman and self-employed have been working in their industry for 3 years

Meezan bank home finance loan

Loan of Rs 0.5 million to Rs 50 million can be taken from Meezan Bank ( 5 lakh to 5 crore rupees )

Tenor : 3 to 20 year

The loan will be repaid in monthly installments of three to twenty years

Processing Fee : 8,000

Meezan bank home loan process

- Fill up the Complete application form And submit

- Attach the required documents along with the application form

- Meezan Bank will verify the customer’s home or office address

- The team will review all customer documents and the final report will be sent to the bank.

- Meezan Bank will seek legal opinion on the property documents you provide

- The bank will send the customer conditional offer letter after fulfilling all the loan requirements from Meezan Bank.

- After the loan is approved, the customer has to open an bank account with Meezan Bank

- After completing all the steps, the customer has to come to Meezan Bank and sign the agreement on all the papers.

- The loan will be given to the customer

Required documents for meezan bank home loan

- Copy of ID card

- Two pictures

- Copy of Utility Bill

- A copy of the credit card bill

- Copy of professional degree

- Copy of Agreement

- Celery slip

- Employment certificate

- Copy of bank statement

- Three years business proof

- Copy of NTN certificate

- Property Papers

Meezan bank home loan application form

Customers who want to take a loan from Meezan Bank will open the link below and fill up the form and submit the required documents to your nearest Meezan Bank.

Download Home Loan Application Form

URL : https://www.meezanbank.com/wp-content/themes/mbl/downloads/easy-home-appform.pdf

Contact these numbers for more information