Bank islami sahulat account is a profit bearing account which developed based on the modes of

Mudarabah (contract between two parties on account to one party should provide capital and the

other should provide labour and skills). It works on the basis of you provide funds to the bank on

the basis of Mudarabah for investment in the Bank’s Shariah Compliant Assets. In this

procedure, you will function as a Rabbul Maal (investor in Mudaraba) and the Bank will act as

the Mudarib (Manager of the Mudaraba). The pool of customers’ fund will formed by the Bank.

The pool management helped in provides of financings to various corporate, individuals, other

entities and the government which based on various Islamic modes of finance such as Ijarah,

Murabaha, Mudaraba, Musharakah, and other modes which would generate income. The pool

will calculated by the Bank on a monthly basis. The Bank and the Depositors will shared the

income on the basis of pre agreed profit sharing ratio. The Mudarib’s share is called by the profit

share of the Bank. At the beginning of the month, the bank and the depositors is determined this

profit sharing ratio. At the beginning of the month, the profit sharing of the depositors will be

based on the predetermined weightages assigned. Additionally, the mechanism of a weightage

based profit distribution ensures that the return paid to any customer either in a profit or loss

sharing contract is proportionated to the risk taken. In the loss case, as per Mudaraba’s rules, the

Rabbul Maal will be borne solely in the loss. The various categories of customers will distribute

the loss on a pro rata basis. The bank will also suffers loss as no income is generated against.

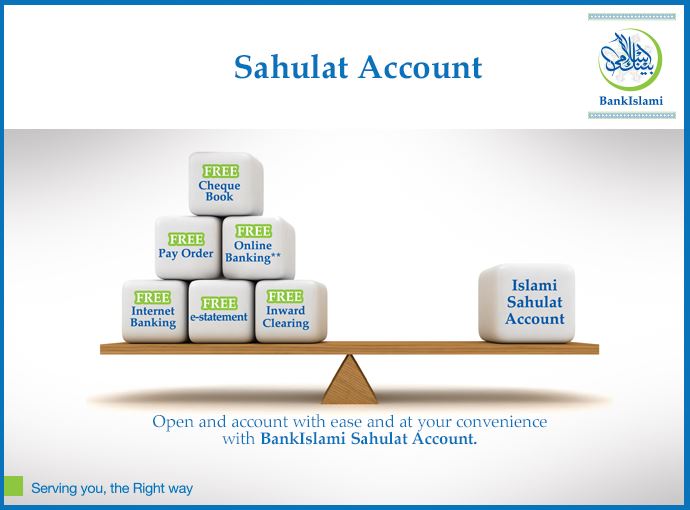

Bank Islami Sahulat Account Benefits

There are so many benefits of Islamic Sahulat Account but we have discuss the major benefits

i.e. the bank will give you a free cheque book, free pay order, free inward clearing, free online

banking, free internet banking, free e-statement and the monthly average balance condition of

25,000 is applied on free services.

Islami Bank Account Opening Requirements

In order to open account in bank islami sahulat, there are various types of documents which you

have to provide to the bank on the basis of customer category. In order to opening of salaried

individual /joint account holders, you have to bring original Computerized National Identity

Card (CNIC) and passport for non-residents only, employment proof like pay slip, employment

order and fill the account open application form. In order to open sole proprietors account, you

should bring original Computerized National Identity Card (CNIC) and Passport (for Non-

residents only) and NTN Certificate and should fill account application form. In order to open

account for Partnership/Club/Society/Association/NGO/Trust, you have provide certified copy of

partnership/ trust deed, certificate of registration, signatures of all partners on letter of

partnership, certified copy of rules, certified copy of resolution, copy of by-laws, copy of NTN

certificate, CNICs of all partners and passports (for Non-residents only) to the bank. In order to

open account for limited company, you have provide certificate of incorporation, certificate for

commencement of business (PLC only), memorandum of association, articles of association,

current list of directors, copy of board resolution, CNICs of all directors, and copy of NTN

certificate and Form 29 to the bank.

How to Open Bank Islami Sahulat Account

In order to open account in bank islami sahulat, you have to follow two ways for opening

account.

No 1.

Go to your nearest Islamic bank and fill up the form and submit it along with the required documents.

No 2.

The second way is the filling of online application form, for online application

form click the link: https://bankislami.com.pk/islami-sahulat-account/