Take advantage of the cheapest home loan scheme in the history of Pakistan and build your own home by taking a loan on easy terms.

Bank Al-Falah provides loans under the mera pakistan mera ghar Scheme to all Pakistanis with a monthly salary of up to Rs 25,000. A loan of Rs 2.7 million to Rs 1 Crore can be taken from Bank Al-Falah to build or buy a house.

Men and women from all over Pakistan who have an ID card can take a loan from Bank Al-Falah under this PM Naya Pakistan housing scheme.

Bank Al-Falah provides loans for two purposes under the mera pakistan mera ghar Scheme

1) To buy a house

This includes buying an apartment and buying a house

2) To build a house

There are two possible ways to do this

If the candidate has a private plot and he only wants to do construction, he can get a loan from Bank Al-Falah.

If the candidate has money to build a house and he just wants to buy a plot, he will get a loan from Bank Al-Falah for the plot.

Basic Eligibility Criteria For Mera Pakistan Mera Ghar Scheme

- All Pakistanis who have an ID card

- People who do not have a private home and want to build their own home for the first time

- For the first time participants in the Government of Pakistan’s subsidy scheme

Eligibility Criteria For Salary Person.

- The age of the candidate should be between 25 to 60 years

- Monthly salary up to 25 thousand

- I have been working continuously for two years

Eligibility Criteria For Businessmen and professionals

- Age range between 25 and 70 years

- Monthly income up to 50 thousand

- The candidate has been in business for three years

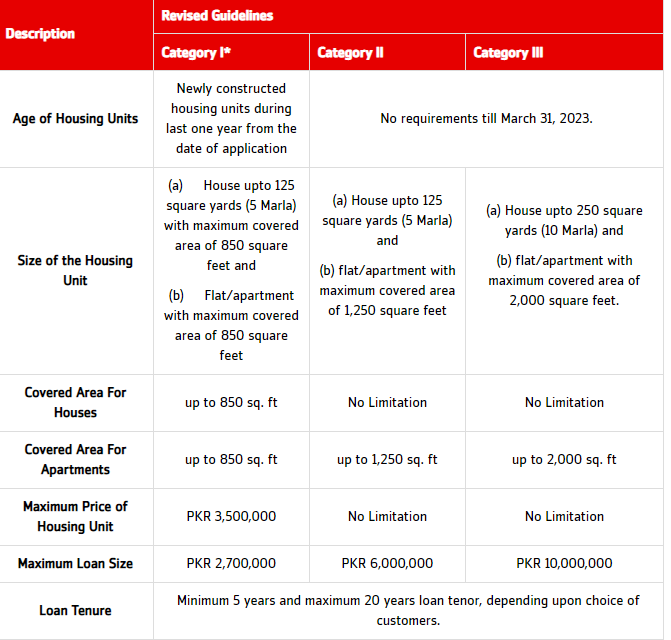

How much can I get a loan from Bank Al-Falah to build a house?

You can get a loan from Bank Al-Falah to build a house of 5 marlas or 10 marlas

Description of five marla house

A five-marla house with sizes ranging from 125 square feet to 850 square feet

A loan of Rs 2.7 million to Rs 3.5 million can be obtained for a five-marla house

Details of ten marla house

10 marla house with sizes from 1250 square feet to 2,000 square feet

A loan of Rs 6 million to Rs 1 crore can be obtained for a ten-marla house

Candidates will have to repay all the loans with a monthly installment of Minimum 5 year to Maximum 20 years

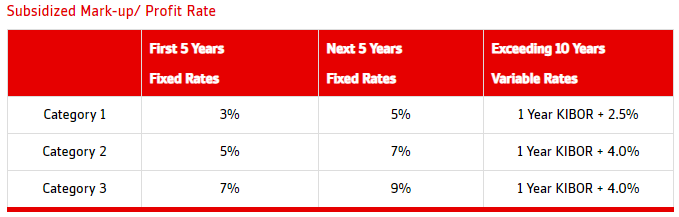

Markup description

Required Documents For Mera Pakistan Mera Ghar housing scheme

Application form

Copy of ID card

Income proof

Property Documents

How To Apply For Mera Pakistan Mera Ghar Loan scheme

Candidates should go to any branch of their nearest Bank Al-Falah and fill up the form and submit it along with the required documents.

Click on this link and find your nearest Bank Al-Falah branch