Quick answer (featured snippet):

The Maryam Nawaz Loan Scheme 2025—commonly known as the Asaan Karobar Finance Scheme / Asaan Karobar Card—is a Punjab provincial initiative offering interest-free (0% markup) loans to small businesses, entrepreneurs, and targeted beneficiaries across Punjab. Loan tiers range from micro amounts up to multi-million rupee facilities, with flexible tenors, grace periods, and simplified online application processes designed to boost entrepreneurship and job creation. Asaan Karobar Finance Scheme+1

Outline (what you’ll find in this article)

- What is the Maryam Nawaz Loan Scheme 2025? (short explainer)

- Why Punjab launched interest-free loans — policy goals and context

- Schemes under the Maryam Nawaz umbrella: Asaan Karobar, Easy Business Finance, Apni Chhat Apna Ghar (overview)

- Who is eligible — categories, age, residency, and exclusions

- Loan sizes, tiers, tenors, and grace periods (how much and how long)

- Application process — online steps, documents, and tips for success

- Real-life examples — case studies of beneficiaries (fictionalized but realistic composite stories based on rollout reports)

- Risks & criticisms — fiscal cost, moral hazard, and implementation challenges

- How banks and fintech partners fit in — public-private delivery model

- Repayment, monitoring, and default management strategies

- Expert perspectives and data points (what economists and observers say)

- How this scheme compares to other interest-free models in Pakistan (Akhuwat, Kissan Card, etc.)

- Practical tips to prepare your application and business plan

- Future outlook — scaling, sustainability, and policy evolution

- Conclusion and 5 FAQs

1. What is the Maryam Nawaz Loan Scheme 2025? (Short explainer)

The Maryam Nawaz Loan Scheme 2025 is a set of provincial initiatives—led by Chief Minister Maryam Nawaz Sharif in Punjab—designed to provide interest-free loans to entrepreneurs, small businesses, and specific social groups (women, youth, rural entrepreneurs). Key components include the Asaan Karobar Finance Scheme / Asaan Karobar Card and other targeted programs that aim to increase access to capital, create jobs, and spur local economic activity. The government has partnered with banks and development institutions to disburse funds and manage repayment. Asaan Karobar Finance Scheme+1

2. Why Punjab launched interest-free loans — policy goals and context

Pakistan’s economy in the mid-2020s faces several persistent challenges: constrained formal credit access for SMEs, youth unemployment, regional disparities, and the need to accelerate post-pandemic recovery. The Punjab government’s decision to offer 0% markup financing reflects three policy goals:

- Promote entrepreneurship by removing the prohibitive cost of borrowing for small enterprises.

- Create jobs through easier business expansion and industrial linkages.

- Bring informal small businesses into the formal financial system, enabling future support and taxation benefits.

The program’s public messaging emphasized job-creation and inclusive growth, and subsequent land allocation promises for industrial linkage indicate a push beyond simple credit delivery to ecosystem-building. Profit by Pakistan Today+1

3. What schemes exist under the Maryam Nawaz program? (Overview)

Several branded initiatives have been launched under Maryam Nawaz’s provincial agenda in 2025. The prominent ones include:

- Asaan Karobar Finance Scheme / Asaan Karobar Card: An MSME-focused, 0% interest product with multiple tiers (micro to medium loans, unsecured and secured options). Asaan Karobar Finance Scheme

- Easy Business Finance / Easy Business Card: Launched to facilitate quick disbursement and structured repayment schedules for small enterprises. dgpr.punjab.gov.pk

- Housing- and land-linked initiatives (Apni Chhat Apna Ghar, Apni Zamin Apna Ghar): While primarily housing/land programs, they include loan elements with subsidized or interest-free components in some phases. Punjab Government+1

Each program targets different beneficiary groups (entrepreneurs, first-time homeowners, agri-producers), and together they form a broader provincial package to stimulate growth.

4. Who is eligible? (Eligibility snapshot)

Eligibility rules vary slightly between schemes, but the common criteria found in official announcements and program guides are:

- Residency: Permanent residents of Punjab with a valid CNIC and Punjab domicile. Asaan Karobar Finance Scheme

- Age bracket: Typical ranges are 21–55 or 25–55 depending on the specific scheme. Business Recorder

- No active default: Applicants should not have an active default with banks or microfinance institutions.

- Business viability: For business loans, a short business plan or evidence of income-generating activity is often required.

- Priority groups: Women entrepreneurs, youth, disabled persons, and marginalized communities receive priority in some windows.

Tiers may impose additional requirements: Tier-1 (micro loans) often requires only a personal guarantee, while higher-tier loans require collateral or documented business history. Always check the scheme-specific portal for the precise checklist. Asaan Karobar Finance Scheme

5. Loan sizes, tiers, tenors, and grace periods

A distinguishing feature is the tiered loan architecture:

- Tier-1 (micro): Unsecured loans up to a smaller ceiling (e.g., PKR 1–5 million), meant for startups and very small businesses. Often requires personal guarantees. Asaan Karobar Finance Scheme

- Tier-2 (medium): Secured loans from PKR 5 million up to PKR 30 million for established businesses; collateral and stronger documentation required. Asaan Karobar Finance Scheme

Typical tenor & grace: Up to 3–5 years repayment, with grace periods ranging from 3–12 months depending on whether the borrower is a startup or an existing enterprise. The Asaan Karobar product, for example, mentions tenors up to 5 years and tailored grace periods for startups. isi.org.pk+1

6. Application process — step-by-step (online & offline)

The scheme prioritizes digital onboarding to speed up approvals. A typical application flow:

- Visit the official portal (Asaan Karobar / CM Punjab portal) or authorized bank branch. Asaan Karobar Finance Scheme+1

- Create/login using CNIC-verified mobile (linked to NADRA’s records).

- Complete a short application form—personal details, business overview, requested loan amount, and intended use.

- Upload documents: CNIC, proof of residence, business documentation (if any), bank statements, and a short business plan or cash-flow estimate.

- Initial screening by the scheme administrators; shortlisted candidates proceed to bank underwriting or a micro-lending partner.

- Approval & card/cheque issuance followed by disbursement—some schemes issue a specialized card (Asaan Karobar Card) to draw funds for business expenses. FemiTech

Pro tip: Prepare a simple one-page business plan and scanned copies of CNIC and bank statements before starting. That reduces back-and-forth and shortens approval times.

7. Real-life examples — how this could change a business (composite case studies)

Case: Saira — a bakery owner in Gujranwala

Saira had an informal bakery with steady local orders but no machinery. She applied for a Tier-1 Asaan Karobar loan (PKR 750,000), secured a small oven and a delivery bike, and hired two staff. Within nine months, her monthly revenue rose by 40% and she began servicing local catering contracts that were previously out of reach. The 3-month grace period allowed sales to ramp up before repayments began. (Composite based on scheme reporting and beneficiary snapshots.) dgpr.punjab.gov.pk+1

Case: Faizan — a small textile unit

Faizan’s unit expanded using a secured Tier-2 loan of PKR 12 million for a new stitching line. The loan’s structured repayment and linkages to allocated industrial land by the provincial government helped integrate his operations into an export value chain. Profit by Pakistan Today

These examples show typical outcomes—but success depends on planning, market linkages, and disciplined cash-flow management.

8. Risks & criticisms — what to watch out for

No large-scale public credit program is risk-free. Key concerns raised by observers include:

- Fiscal burden: Large interest subsidies can strain provincial budgets if the program scales rapidly. Critics ask whether ongoing sustainability and budgetary space have been fully accounted for. dgpr.punjab.gov.pk

- Moral hazard & misuse: Interest-free loans can be misused if underwriting and monitoring are weak—leading to defaults and political patronage risks.

- Implementation capacity: Rapid rollouts require trained bank partners, monitoring systems, and anti-fraud safeguards—which are operationally intensive.

- Targeting mistakes: Poor beneficiary selection could direct funds away from genuinely productive entrepreneurs to less productive uses.

Policymakers must balance speed and inclusiveness against sound credit discipline to avoid future NPL (non-performing loan) buildups.

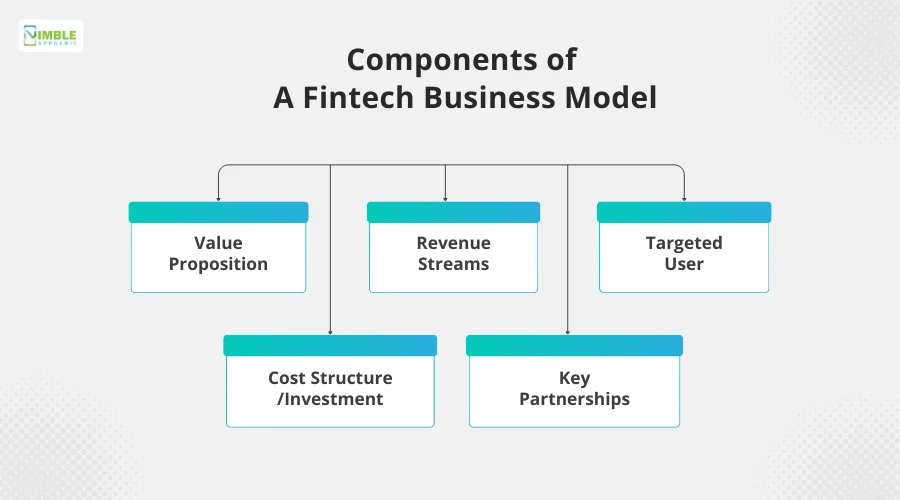

9. How banks and fintech partners fit in (delivery model)

Punjab’s approach relies on public-private collaboration:

- Provincial government sets policy, funding windows, and eligibility frameworks.

- Participating banks (state and private) handle underwriting, disbursal mechanics, and repayment monitoring. The Bank of Punjab has been explicitly named among partners in rollout events. Profit by Pakistan Today

- Fintechs & microfinance institutions may support digital onboarding, KYC automation, and last-mile outreach—helpful for rural and female entrepreneurs.

This hybrid model helps combine the state’s budgetary muscle with banks’ risk-management and fintech speed.

10. Repayment, monitoring, and default-management strategies

To keep the program healthy, the administration and banks are using several measures:

- Structured repayment schedules with grace periods and lower monthly instalments to match cash flows. dgpr.punjab.gov.pk

- Digital monitoring via the Asaan Karobar Card and transaction tracking to detect early stress signals. Asaan Karobar Finance Scheme

- Graduated escalation—early resolution, restructuring options for viable businesses, and recovery actions for willful defaulters.

- Linkages with industrial land and supply-chains (for select beneficiaries) to enhance survival chances and reduce default risk. Profit by Pakistan Today

Strong MIS (management information systems) and public transparency on disbursals will be crucial to maintain confidence.

11. Expert perspectives & data points

Economic observers see potential but urge caution:

- Pro-growth effect: Interest-free micro-credit can unlock productive investment among the credit-constrained, leading to higher employment—especially if accompanied by training and market linkages. Several pilot programs globally (and local examples like Akhuwat) show durable benefits when combined with social intermediation. isi.org.pk

- Fiscal trade-offs: Analysts remind policymakers of trade-offs—every rupee in subsidy is a rupee not available for healthcare or education unless offset by growth dividends from successful businesses. dgpr.punjab.gov.pk

The early 2025 rollouts and land-allocation promises suggest a willingness to connect credit with broader industrial policy, which some experts view as a positive integration step. Profit by Pakistan Today

12. How this compares to other interest-free models in Pakistan

Pakistan has precedents:

- Akhuwat Foundation: A well-known NGO providing interest-free microloans with social collateral (community guarantees). It has a strong repayment culture and social support model. isi.org.pk

- Kissan Card & other farmer support schemes: Often include partial subsidies, increased credit limits, and targeted support for agricultural inputs. Facebook

Punjab’s new schemes differ mainly in scale, provincial backing, and formal bank-partner mechanisms. Combining Akhuwat-style social support with formal banking could be a promising hybrid if implemented.

13. Practical tips: How to prepare a strong application

- One-page business plan: Clear problem, revenue model, break-even timeline, and how the loan will be used.

- Financial snapshot: Last 6–12 months of bank statements; projected monthly cash-flow for 12 months.

- Legal documents: CNIC, domicile, proof of business address, and any licenses.

- Realistic ask: Request the amount you can service; smaller initial loans with strong performance increase chances for future scaling.

- Market proof: A few customer invoices or supplier contracts go a long way to convince underwriters.

Applicants should also keep their mobile number linked to CNIC (NADRA verification) to avoid delays.

14. Future outlook — sustainability, scaling, and evolution

For long-term success, three things matter:

- Integration with training & markets: Loans plus business development support raise survival rates substantially.

- Strong digital systems: Monitor usage and detect fraud early; payments data can be used to refine underwriting. Asaan Karobar Finance Scheme

- Fiscal sustainability: Periodic independent evaluations to measure job creation, default rates, and ROI on public subsidies are essential.

If managed well, the scheme could become a model for provincial-led industrial acceleration and SME formalization.

15. Conclusion (what to remember)

The Maryam Nawaz Loan Scheme 2025 represents an ambitious push by Punjab to use interest-free financing as an accelerator for entrepreneurship and jobs. The Asaan Karobar Finance Scheme and related programs offer accessible loan tiers, digital onboarding, and linkages to industrial land and bank partners. Early rollouts show promise—real impact will depend on tight implementation, recovery discipline, and complementary support like training and market access. If you’re an entrepreneur in Punjab, this is a real opportunity—but treat it like any commercial decision: plan carefully, borrow responsibly, and use the funds to grow revenue, not just cover expenses. Asaan Karobar Finance Scheme+1

FAQs (5 unique, useful answers)

Q1: Who can apply for the Maryam Nawaz Asaan Karobar loan?

A1: Permanent residents of Punjab who meet age criteria (typically 21–55/25–55), have no active banking defaults, and present a feasible business plan are eligible. Priority is often given to women, youth, and marginalized groups. Exact criteria can vary by scheme—check the official Asaan Karobar portal or participating bank for details. Asaan Karobar Finance Scheme

Q2: Are these loans truly interest-free?

A2: Yes—the core promise of Asaan Karobar and similar 2025 initiatives is a 0% markup (interest-free) structure for the borrower. However, there may be administrative fees or service charges in some products; read the scheme terms carefully and consult the official documentation. Asaan Karobar Finance Scheme

Q3: How long does approval and disbursement take?

A3: Timelines vary. Digital-ready, well-documented applicants can receive approval within weeks; more complex, higher-tier loans require thorough underwriting and take longer. The presence of a dedicated card or fast-track window in some programs speeds small loan disbursement. dgpr.punjab.gov.pk+1

Q4: What happens if I can’t repay on time?

A4: Early-contact and restructuring options are typically offered for viable businesses. Willful defaulters face recovery actions. It’s essential to maintain communication with the lending bank to explore restructuring or temporary relief if cash flows deteriorate. dgpr.punjab.gov.pk

Q5: How does this scheme differ from Akhuwat loans?

A5: Akhuwat is an NGO model using community/social collateral to provide microcredit with a strong emphasis on social support and near-universal repayment culture. The Maryam Nawaz schemes are provincial, bank-partnered, and larger in scale—aimed at a broader MSME base with formal underwriting and institutional monitoring. Both aim to expand access but use different delivery models.