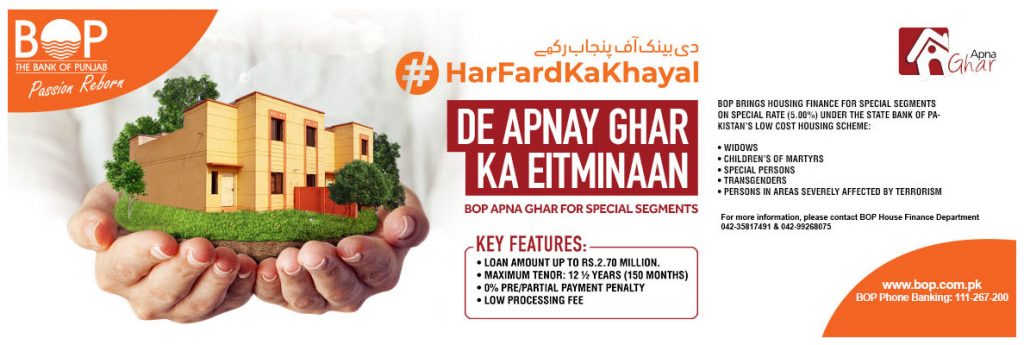

Your home is the center of your world, home is a place where you find peace and comfort. Bank of Punjab understands your desire about your home and how to make your house truly your home. Bank of Punjab House Financing Scheme ensures this happens in few steps:

Additionally, Bank of Punjab Apna Ghar (Self Home) financing scheme is a House Financing facility for: purchasing of already constructed home, purchase of plot on account to construct a home, construction of home on self-owned plot, renovation of home.

Bank of Punjab Home Loan Benefits

| Loan Purposes | Minimum Tenure of Loan | Maximum Tenure of Loan | Grace Period of Loan |

| Purchasing of constructed residential apartment and house | Three (3) Years | Twenty Five 25 Years | No grace period allowed during Loan |

| Purchase of plot and construction | Up to Twelve (12) months | ||

| Construction of house on self-owned plot | |||

| Renovation of self-owned house | One (1) Year | Ten (10) Years | Transaction Nature which Up to Twelve (12) months. |

Bank of Punjab Home Loan Eligibility Criteria

| Items | Salaried Individuals | Self Employed Businessmen/ Professionals | Non Residential of Pakistan |

| Age Limit: | Up to 20 to 60 Years | Up to 25 to 65 Years | Up to 25 to 65 Years |

| Experience in Job: | 3 years job experience (i.e. Permanent/ contractual employees) | 3 years in current business or profession | Valid documentary proof of minimum 1 year of SI or 3 years for SEB/ SEP |

| Salary based Income: | At least gross salary per month: a. Permanent employee PKR 40,000/- b. Contractual employee PKR 50,000/- | At least monthly income Rs.50,000/- | At least monthly verify income PRs. 300,000/- valid work visa |

Bank of Punjab Home Loan Required Documents

| Salaried Individuals | Self Employed Professionals/ Businessmen | Non Residential of Pakistan |

| 1) One valid copy of CNIC Self Spouse (if married) 2) Two References Co-borrower (if any) | 1) One valid copy of CNIC Self Spouse (if married) 2) Two References Co-borrower (if any) | 1) One valid copy of CNIC Self Spouse (if married) 2) Two References Co-borrower (if any) |

| Four passport size photographs | Four passport size photographs | Four passport size photographs |

| One valid copy of utility bill of residence | One valid copy of utility bill of residence and business place | One valid copy of utility bill of living address which stay in Pakistan |

| Application Form Complete | Application Form Complete | Application Form Complete |

| Salary slip (At least last 3 months) | Documentation Proof of business NTN, Registration with concerned Governing body etc. | One valid copy of valid work visa |

| Statement of Bank (at least last 6 months, describing last 6 salary credits) | Statement of Bank for last 12 months | Refer to documents which listed in Salaried Individual if NRP is SI |

| Form 29 and Partnership Contract | Refer of documents which listed based on Professional/ Self Employed/ Businessmen | |

| One valid copy of Professional Degree, if applicable | ||

| Tax returns at least last 3 years |

Bank of Punjab Markup Rate

· For knowing the current Markup rate please visit your nearest Bank of Punjab Branch or their Website.

Installment Procedure:

· The installment procedure is based on monthly which should be deposited in your BOP A/C on or before 5th of each month.

Penalty of Late Payment:

· In the late payment case, One thousand (1000) per day of installment amount from due date till the actual payment shall be charged from the customers.

Additional Charges:

· At the rate of three percent (3%) of Principal Amount, you will be charged prepayment penalty.

Other Charges:

· One time processing fee (non-refundable) will have to be paid by the customer.

· Processing Fee: SI / SEP = PKR 8,000/- while Others = PKR 10,000/-

Property Locations:

· To know the property locations visit the official website of The Bank of Punjab: https://www.bop.com.pk/BoP

Rights and Obligations:

| Duties/Obligations: | Rights: |

| The customer should provide everything on time like important information about the facility. | To receive notifications of any changesWithin 30 days of the announcement in terms and conditions. |

| Payment must be made by the customer in accordance with the terms agreed in the finance agreement. | To receive the schedule of repayment in free of cost. |

| To maintain adequate funds in a bank account for monthly deductions | Contacting bank officials during business hours. |

How to Apply for Apna Ghar Financial Scheme

Please visit your nearest The Bank of Punjab branch and fulfill the application form with required documents.